The open banking trend was slow to take off, but as we predicted in our top FinTech trends for 2020, its time has come. And that’s exactly what the modern connected consumer demands. In short, open banking promotes a greater degree of bank account aggregation arrangements that allow customers to cherry-pick the best offers from the market and build a personalized financial hub based on their needs.

Best financial software for aggregating diverse accounts plus#

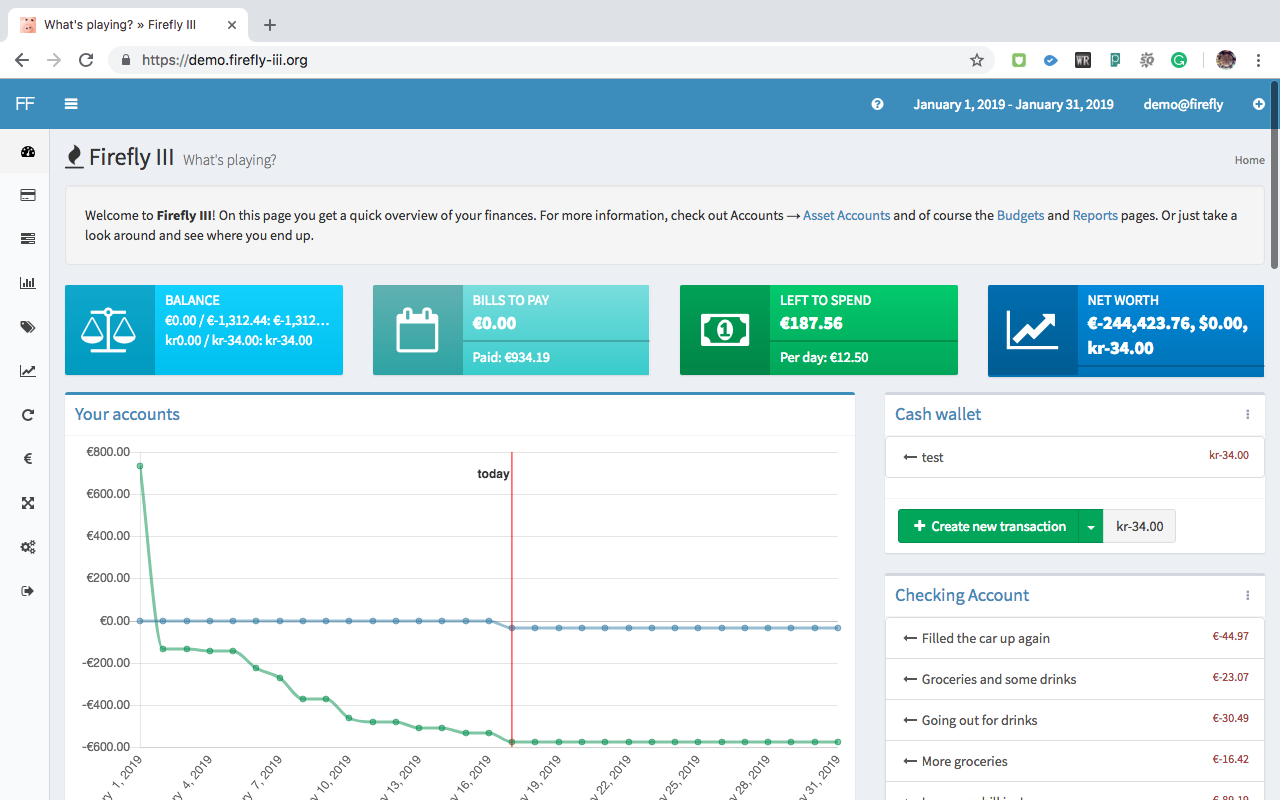

Boston Consulting Group Account aggregation versus or plus open banking? Already, 83% of digital ecosystems involve partners from more than three industries. The ability to build, manage, and collaborate in complex business ecosystems will be a major competitive advantage in the decade ahead. capitalizing on customer analytics and insights.įurthermore, account aggregation apps are driven by the network effect - the more integrations they offer, the more valuable they become for new partners and end users.Ĭonsidering that most intermarket competition is happening at an ecosystem level, assuming the role of an aggregator may be a winning move for some companies.deploying value-added products and services to consumers.building partnership agreements with incumbent and FinTech players.Think about how your email account is the hub for so many things in your life - personal and business communication, PayPal purchases, Venmo transfers, Uber rides, and late-night sushi orders.Īccount aggregators attempt to assume the same role but offer an even more granular view into all financial aspects of your life from a single dashboard.īeing this keyholder to all customer data gives account aggregation services an upper hand on the financial market. Investment and portfolio management tools.Lending portals and credit scoring systems.Budgeting and personal finance management apps.In essence, account aggregation services act as universal connectors, pulling transactional, savings, investment, tax, and credit data together into one virtual warehouse that can then be plugged into any type of financial application: What is account aggregation?Īccount aggregation is the process of housing all of a consumer’s financial data under one roof. Amidst the range of choices, modern consumers may start feeling that less is more and steadily drift toward account aggregation.

Today’s financial industry has no lack of solutions. Your average Millennial (and even their progressive Boomer parents) carries multiple cards, holds several investment accounts, uses investment apps, and sends money using any method but a bank. Even the average unbanked and underbanked consumer uses several alternative financial accounts.

In the second decade of the twenty-first century, that’s a hard scenario to imagine.

Back in the day, everyone had one trusted bank account and a branch manager to dole out money on demand.

0 kommentar(er)

0 kommentar(er)